On July 29, Starbucks released its Q3 financial report for fiscal year 2025 (ending June 29). The global coffee giant brought in $8.918 billion in revenue from its café operations, slightly surpassing market expectations. A key driver of this growth was the addition of 1,151 new company-operated stores worldwide over the past 12 months, contributing $927 million in incremental sales.

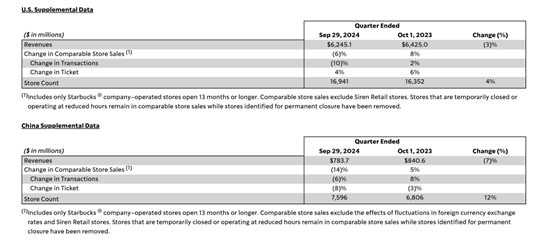

North America remains Starbucks’ foundation, accounting for $6.927 billion in revenue—about 73% of its total café income—with only modest year-over-year growth of 1.6%. Meanwhile, China, the company’s second-largest market, generated $790 million in Q3 revenue, up 8% year-over-year. This marks one of the top three quarterly performances for the market since FY2023.

China’s growth came largely from aggressive expansion—adding 522 stores in one quarter—and strategic pricing tactics like menu adjustments and discounts through delivery platforms. These moves helped reverse four consecutive quarters of declining same-store sales, with same-store revenue and transaction volume growing by 2% and 6%, respectively. As of June, Starbucks operated 7,828 stores in China—about 19% of its 41,097 global locations—but this footprint accounted for only 8% of global revenue.

In 2017, Starbucks went all-in on China by acquiring full control of its East China operations, achieving double-digit sales growth and peaking at a 12% share of company-wide revenue. At its height, Starbucks commanded 42% of China’s chain coffee market, thanks to its "third place" concept: a premium space between home and work. Shanghai became its only administrative headquarters outside Seattle.

But times have changed. Despite record store counts, Starbucks’ market share in China has plunged to just 14% in 2024. The coffee market itself has boomed, but Starbucks' revenues have merely stabilized. Rising domestic competitors like Luckin Coffee have reshaped consumer habits, selling affordable grab-and-go coffee and pushing the entire industry away from experiential spaces toward convenience and pricing.

In Q2, Luckin posted 47.1% year-over-year growth with 12.36 billion yuan ($1.7 billion USD) in revenue—about 2.5 times Starbucks China. In volume terms, the gap is even larger given Luckin’s lower pricing.

Initially dismissed as non-competitors, Luckin and similar brands have since altered the consumer landscape. While Starbucks still relies on ambiance and service, Luckin has normalized coffee as an everyday, low-cost beverage. Consumers now question whether Starbucks’ premium pricing is worth it—especially when a comparable cup can cost less than 10 RMB.

Starbucks’ core challenge isn’t just Luckin’s pricing—it’s a deeper shift in the definition of coffee itself. What used to be a luxury experience is now seen as functional and fast. Starbucks is struggling to defend its "third space" identity in a market increasingly defined by price and convenience.

Though Starbucks’ China stores still lead in per-store revenue (730,000 RMB annually vs. Luckin’s 540,000), the gap is narrowing. Starbucks’ efforts to respond—such as reducing the price of iced beverages by an average of 5 RMB—have helped slightly, but feel more like tactical patches than strategic solutions.

The brand has also resorted to more promotions on delivery platforms, albeit discreetly, by bundling drinks or offering discount cards. Still, more and more consumers no longer value the Starbucks "experience" and are comparing it directly with rivals on price and speed.

Long-term fixes may require structural changes. Toward the end of 2023, reports emerged that Starbucks was exploring strategic options for its China operations, including partial equity sales. By early 2025, this had materialized into real negotiations. Over 20 investors—including Hillhouse Capital, Carlyle Group, DCP Capital, and China Resources—have expressed interest.

These firms bring capital, tech, and experience in China’s fast-moving food and beverage space. For example, Hillhouse backed Heytea and Mixue Bingcheng; Carlyle helped McDonald’s China expand; and China Resources is behind both Pacific Coffee and Oatly. DCP Capital is a major investor in none other than Luckin Coffee.

Starbucks CEO Laxman Narasimhan (Brian Niccol) confirmed the interest in a recent earnings call, reiterating the company’s commitment to China while expressing openness to retaining a significant share of the business.

Historically, Starbucks has maintained strict control over its brand and operations. It has gradually bought back joint ventures in China over the years—from North China in 2006 to South and East China by 2017—to build a fully owned local network. That full-ownership model ensured brand consistency and control over the "third place" concept.

Now, the shift toward strategic partnerships is less about abandoning control and more about leveraging local expertise in digital operations, franchising, and product innovation—areas where local rivals have outpaced Starbucks.

Analysts point out that Starbucks' heavy reliance on self-operated stores slows its expansion compared to asset-light, franchised competitors. Meanwhile, it’s playing catch-up in digital engagement and local taste innovation.

At an estimated valuation of $5–6 billion USD, Starbucks China contributes less to the company’s global valuation than one might expect—only about 5%, despite accounting for nearly 20% of global stores. This implies Starbucks China has gone from being the company’s crown jewel outside the U.S. to a discounted asset in need of reinvention.